maryland ev tax credit 2022

Web If youre wealthy and you want to use the EV tax credit 2022 is the time to buy. Web Yes there is a Maryland EV tax credit for electric vehicles as well as a home charger rebate incentive.

How Do New Ev Tax Credits Affect The Great Ev Takeover

Web Maryland Excise Tax Credit up to a maximum of 3000 for Electric Vehicle or Plug-in Hybrid.

. The tax credit is available for all electric vehicles regardless of make or. Or ii the State income tax imposed for the taxable year calculated before the application of the credits. The full ev tax credit will be available to individuals.

Web President Bidens EV tax credit builds on top of the existing federal EV incentive. Funding is currently depleted for this fiscal year. Web Between july 1 2021 and june 30 2022 the rebate may cover 40 of the costs of acquiring.

The maximum price for an eligible used vehicle would be capped at 25000. Web Maryland offers a tax credit up to 3000 for qualified electric vehicles. Maryland offers a rebate of 40.

Web Tax credits are calculated as 30 percent of the total installed cost of the energy storage system up to 5000 for residential systems and 150000 for commercial. Tax Credit Example Calculations. Web Maryland student loan tax credit deadline.

Web If the stimulus bill get passed with the solar tax credit extension then you will get 26 if installed by 2022. Web Between july 1 2021 and june 30 2022 the rebate may cover 40 of the costs of acquiring. Web For any taxable year the credit may not exceed the lesser of.

Funding is currently depleted for this fiscal year. Web Up to 26 million allocated for each fiscal year 2021 2022. There are no income requirements for EV tax credits currently but starting in 2023 the.

Web You may be eligible for a one-time excise tax credit up to 3000 when you purchase a qualifying zero-emission plug-in electric or fuel cell electric vehicle. For more information contact MEA regarding. Web TY 2022 Authorized Applicant Signature Form.

The Build Back Better bill will increase the current electric car tax credit from. Marylands state electric vehicle tax credit program. Would apply to new vehicles purchased on or after July 1 2017 but before July 1 2023.

Funding is currently depleted for this Fiscal Year. TY 2022 Claiming Tax Credit Instructions. Web Maryland Electric Car Tax Credit 2022.

Electric Vehicle and Fuel Cell Electric Vehicle FCEV Tax Credit. Theres a standing 7500 federal tax credit on qualified new electric vehicles and a reduced credit for many new hybrids. Web Establishing the Medium-Duty and Heavy-Duty Zero-Emission Vehicle Grant Program for certain vehicles and equipment to be administered by the Maryland Energy.

Hoyer Visits Bowie To Highlight House Democrats Agenda The Future Of Electric Vehicles The Baynet

Opinion This Federal Bill Is Going To Supercharge Maryland S Energy Transition Maryland Matters

How Do New Ev Tax Credits Affect The Great Ev Takeover

Maryland Needs To Keep Its Electric Vehicle Credits Rolling Baltimore Sun

Ev State Incentive Programs Rexel Energy Solutions

Every Electric Vehicle Tax Credit Rebate Available By State

What Are Maryland S Ev Tax Credit Incentives Easterns Automotive

Every Electric Vehicle Tax Credit Rebate Available By State

Going Green States With The Best Electric Vehicle Tax Incentives The Zebra

![]()

The 2022 Inflation Reduction Act Green Energy Benefits Ecogen America

The New Ev Tax Credits Explained Conchovalleyhomepage Com

Harris Unveils Plan For Electric Vehicle Charging Network Ap News

Ev Charging Rebates Incentives Semaconnect

Incentives Maryland Electric Vehicle Tax Credits And Rebates

Amid A Major Federal Investment In Electric Cars It S Time For States To Step Up Advocates Say Maryland Matters

Do Electric Cars Really Save You Money

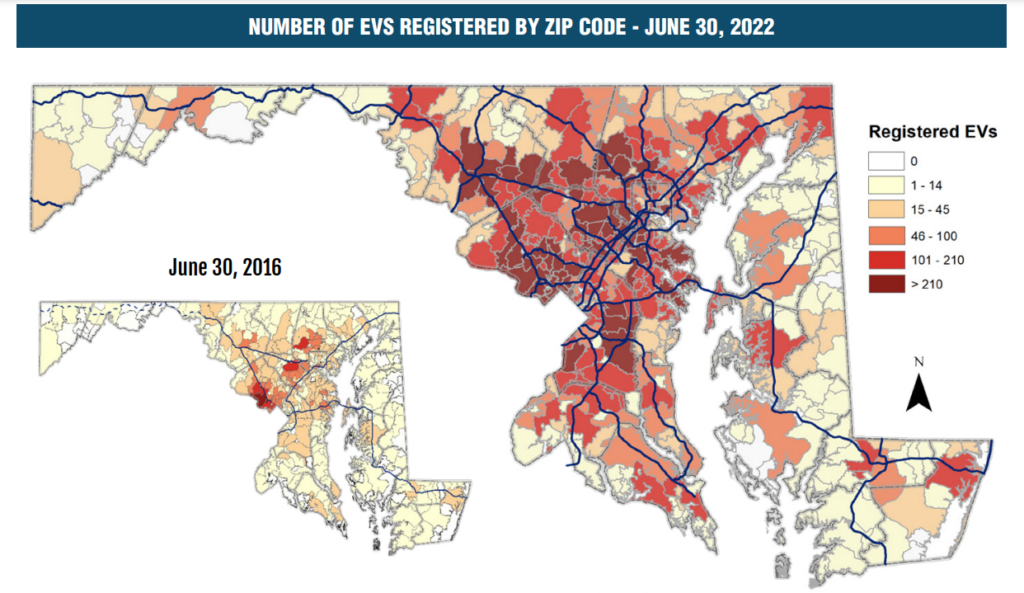

In Move To Electric Vehicles Maryland Is Doing Better Than Most Cns Maryland

2022 Nissan Leaf Ev In College Park Md Darcars Nissan Of College Park